In order to simplify the audit of accounting records or the analysis of records by internal stakeholders, subsidiary ledgers can be created. As such, the journal and ledger both have the most crucial roles in an accounting process to ensure that no transaction is missed out. For any details on the free freelance independent contractor invoice template transaction, confusion or rectification, accountants refer to these two books of accounts. The income statement will also account for other expenses, such as selling, general and administrative expenses, depreciation, interest, and income taxes.

- This data from the trial balance is then used to create the company’s financial statements, such as its balance sheet, income statement, statement of cash flows, and other financial reports.

- Transactions may be caused by normal business activity, such as billing customers or recording supplier invoices, or they may involve adjusting entries, which call for the use of journal entries.

- Blockchain allows the ledger to be distributed across users worldwide, and each user is part of the entire network, making it less dependent on a single centralized node.

- The process of transferring information from the General Journal to the General Ledger, for the purpose of summarizing, is known as posting.

- It is worthwhile for transactions of a similar nature to be sorted out and accumulated in one place.

Ask Any Financial Question

As long as the ledger accounts are being updated in a timely manner, management can see the summarized revenue and expense information for a business, which allows them to take corrective action as needed. The ledger accounts are also summarized into financial statements, which are needed by investors, creditors, lenders, and government agencies. The following Ledger accounts example provides an outline of the most common Ledgers.

In accounting software, a general ledger sorts all transaction information through the accounts. Also, it is cash flow from operating activities cfo definition the primary source for generating the company’s trial balance and financial statements. The ledger’s accuracy is validated by a trial balance, which confirms that the sum of all debit accounts is equal to the sum of all credit accounts. A general ledger is the foundation of a system employed by accountants to store and organize financial data used to create the firm’s financial statements.

Written by True Tamplin, BSc, CEPF®

Ledgers also provide the ability to prepare reports such as balance sheets and cash flow statements which can be used by business owners, managers, accounting transaction analysis and employees for decision-making purposes. In accounting, a General Ledger (GL) is a record of all past transactions of a company, organized by accounts. General Ledger (GL) accounts contain all debit and credit transactions affecting them.

Is it mandatory for businesses to prepare an accounting ledger?

Since every transaction affects at least two accounts, fully recording its impact on the ledger requires us to make two entries for each transaction. For example, when furniture is bought on credit for $4,000 from Fine Furniture Co., we will need to make an entry of $4,000 on the debit side of the furniture account (i.e., because this asset is increasing). These entries will, of course, be made in two different asset accounts, but the amount will be equal. This is to ensure that each transaction affects the balance sheet in such a way that an increase on one side of the balance is offset either by a decrease on the same side or by an increase on the other side.

The left-hand side is known as the debit side and the right-hand side is the credit side. Journals are used to record transactions chronologically, but journal entries only show the effect of individual transactions. A cash book functions as both a journal and a ledger because it contains both credits and debits.

Subsidiary Ledgers

For example, cash and account receivables are part of the company’s assets. Accounting ledgers can be displayed in many different ways, but the concept is still the same. Ledgers summarize the balances of the accounts in the chart of accounts. In the standard format of a ledger account, the balance is not stated after each transaction. The standard form of a ledger account does not show the balance after each entry.

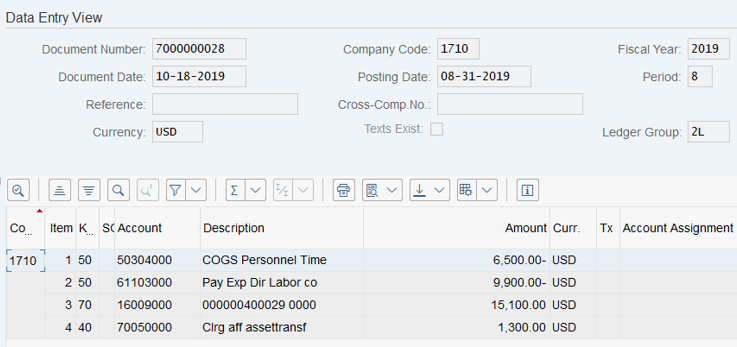

In addition, they include detailed information about each transaction, such as the date, description, amount, and may also include some descriptive information on what the transaction was. General ledgers have the columns of date, description, debit and credit amount. The description could be an expense, revenue, liability, asset or equity entry. As discussed before, the financial entries are first recorded in a general journal. For example, goods purchased with cash will be recorded in the the general journal as a journal entry.